Crypto Markets Retreat as Fed Holds Rates and Risk-Off Sentiment Spreads

Despite the Federal Reserve keeping interest rates steady at 3.5%-3.75%, rising geopolitical tensions and a shift into safe-haven assets pressured crypto markets.

Bitcoin BTC $82,550.64 fell back toward $88,000, while U.S. stocks showed mixed performance, with the S&P 500 briefly surpassing 7,000 before pulling back amid earnings reports from major companies.

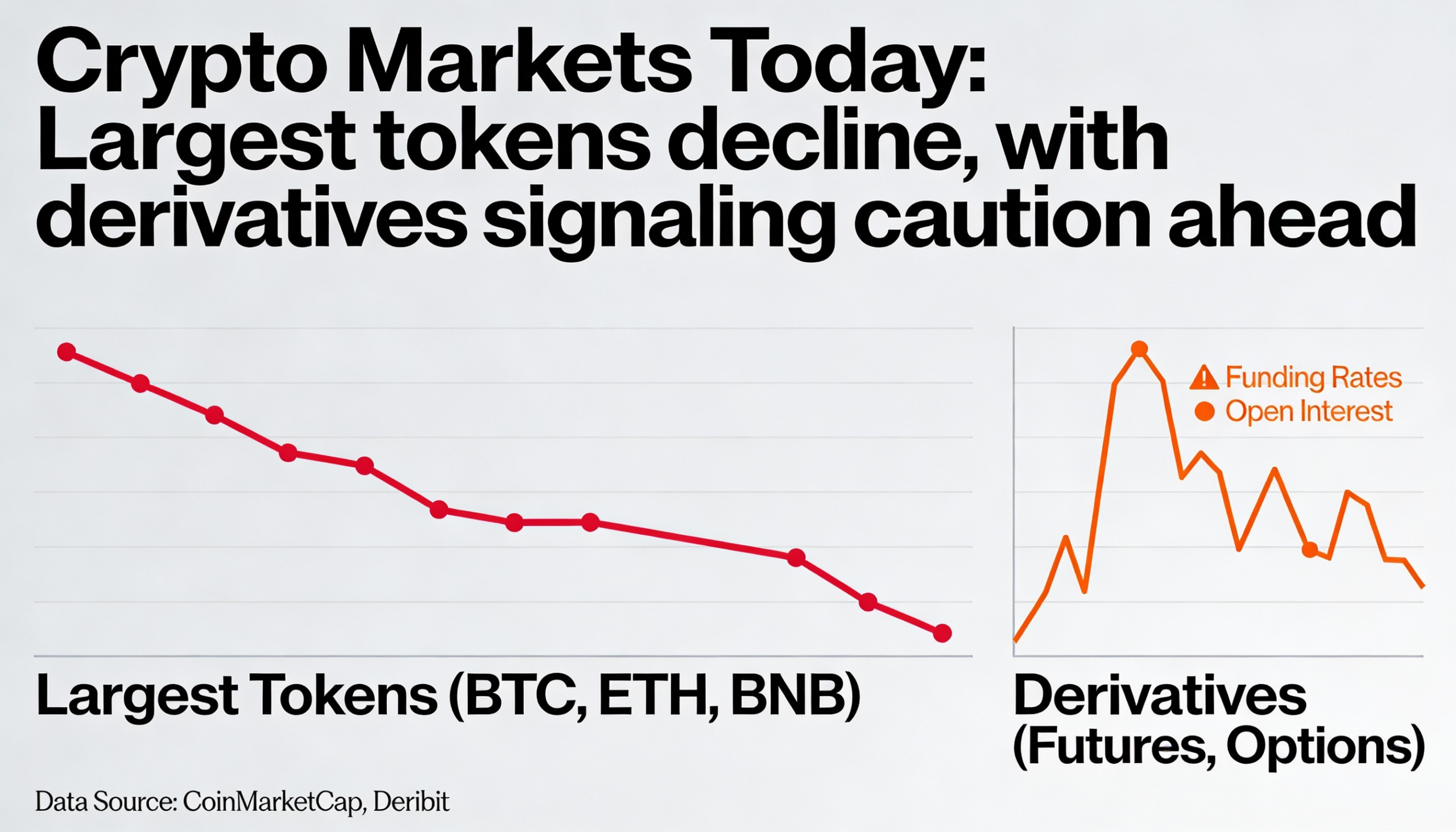

Crypto losses were more pronounced: the CoinDesk 20 (CD20) index dropped 2.9%, gold surged past $5,500 an ounce—lifting XAUT $4,897.90—and silver climbed to $117. Bitcoin continues to behave as a liquidity-sensitive risk asset rather than a traditional hedge, even as the U.S. Dollar Index (DXY) touched a four-year low.

Derivatives & Market Signals

- Crypto futures open interest fell nearly 3% to $132.26 billion.

- $348.3 million in long positions were liquidated over 24 hours.

- BTC and ETH 30-day implied volatility remains near multimonth lows, signaling calm expectations.

- Perpetual funding rates for major tokens hover near zero; XLM funding turned negative.

- Options markets show BTC and ETH puts trading at a premium, with stronger put bias in ether.

Token Updates

- Optimism approved a 12-month plan to buy back OP tokens using network revenue. Pending final approval, ETH from sequencer fees will be converted into OP starting February.

- Half of the Superchain’s $17 million revenue last year will fund monthly token purchases.

- OP has lost 80% over the past year and fell another 5% in the last 24 hours, trading below 29 cents.