Gold and other hard assets are rallying on a weaker dollar, but bitcoin has remained largely range-bound, highlighting its role as a liquidity-sensitive risk asset rather than a traditional hedge.

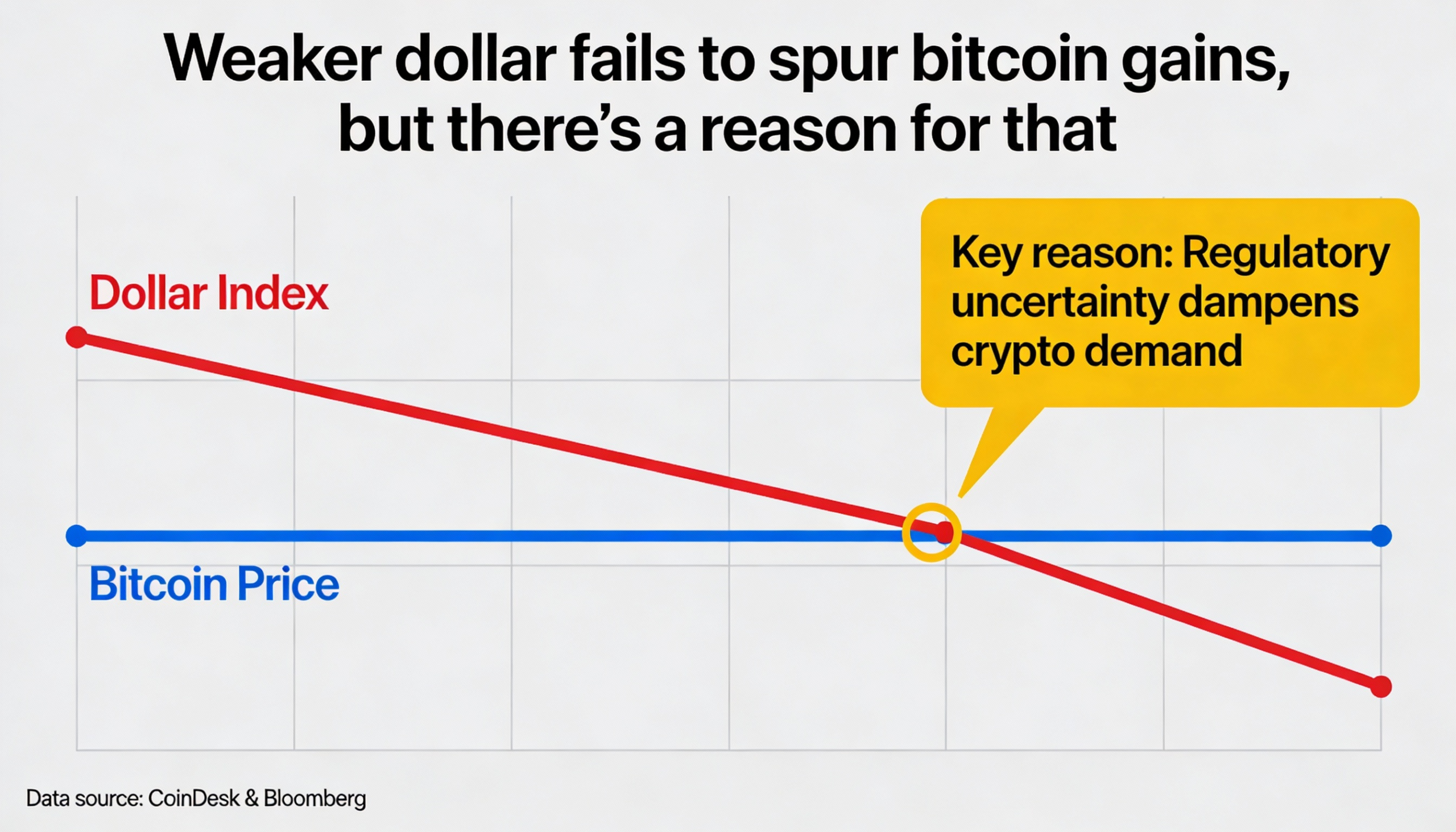

The Dollar Index (DXY) has fallen roughly 10% over the past year. Historically, bitcoin tends to rise when the dollar weakens, yet BTC has lost 13% during the same period, while the broader CoinDesk 20 index (CD20) dropped 28%, according to CoinDesk data.

J.P. Morgan Private Bank attributes the disconnect to the nature of the dollar’s decline. “The recent dollar slide isn’t about growth or monetary policy changes,” said Yuxuan Tang, head of macro strategy in Asia. “Interest rate differentials have actually moved in the USD’s favor since the start of the year. What we’re seeing now, much like last April, is a USD selloff driven primarily by flows and sentiment.”

The bank expects the dollar’s weakness to prove temporary, stabilizing as the U.S. economy strengthens. While gold and other hard assets have benefited, bitcoin remains range-bound, suggesting the market does not view this as a durable macro shift.

Without a clear change in monetary policy or growth expectations, dollar weakness alone has been insufficient to attract fresh capital into crypto. J.P. Morgan highlights gold and emerging-market assets as more direct beneficiaries, leaving bitcoin to behave like a high-beta risk asset.