Altcoins rally as dollar sinks to four-year low; bitcoin steadies

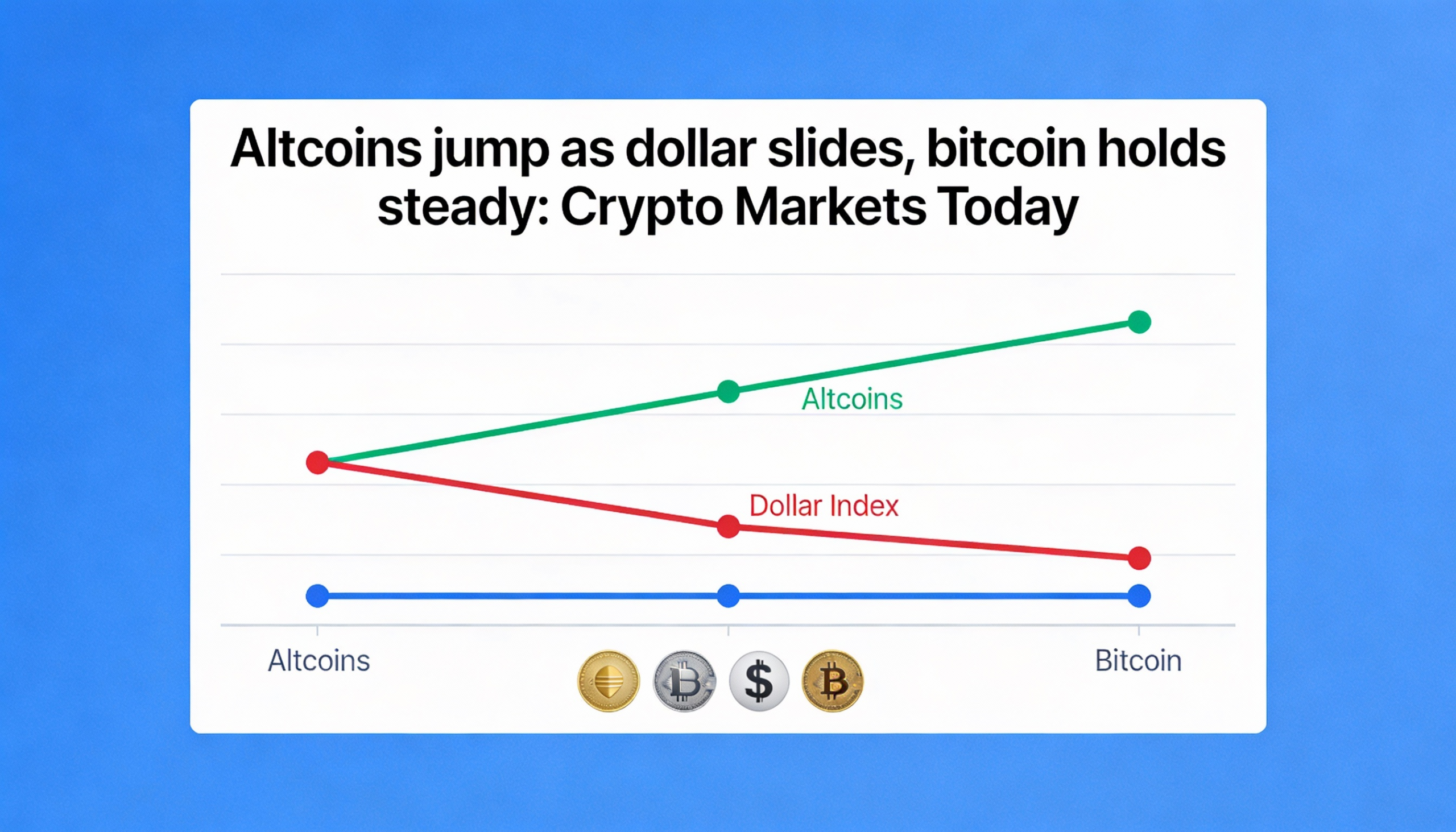

Altcoins led crypto markets higher on Wednesday as the U.S. dollar fell to its weakest level in four years, while bitcoin held a narrow range and ether pulled back slightly.

The Dollar Index (DXY) dropped below a trendline that had been intact since 2011, despite President Donald Trump asserting that the dollar was “doing great” and that he was “not concerned.” Dollar movements remain a key driver for crypto, given that most digital assets are priced against the greenback. Historically, the inverse relationship is pronounced: during the last bear market, the dollar rose roughly 22% between November 2021 and October 2022, while bitcoin lost more than 70% of its value.

Bitcoin (BTC $83,014.34) traded largely unchanged after gains on Tuesday, and ether (ETH $2,733.70) gave back some of its recent advance. By contrast, select altcoins saw strong upward moves. Hyperliquid’s HYPE token rose 11% since midnight UTC, and Solana liquid staking token Jito (JTO $0.3510) surged 32%, marking its biggest single-day gain since December 2023, according to CoinDesk data.

Derivatives point to cautious optimism

Liquidations continued in leveraged crypto positions, with roughly $230 million in bullish futures wiped out over 24 hours. Despite these losses, one-day and 30-day implied volatility for BTC and ETH remain low, suggesting traders do not expect major swings ahead of the Federal Reserve’s interest-rate decision.

Open interest in HYPE futures jumped more than 20% in dollar terms, reflecting price gains, while BTC, ETH, XRP, and BNB futures saw OI rise 2–4%. Annualized funding rates for most major tokens remain positive, indicating a bias toward long positions, except for ZEC and TRX. On Deribit, BTC and ETH puts trade at a premium to calls, with activity concentrated in BTC $85,000 strike puts, signaling demand for downside hedges.

Altcoins in focus

Top performers included Solana-based memecoin PIPPIN, created by AI innovator Yohei Nakajima, which soared 64% and ranked as the most purchased token by “smart money” investors, according to Stalkchain. Hyperliquid’s HYPE and JTO also saw significant gains.

Other decentralized exchange tokens advanced as well: Jupiter (JUP $0.2040) rose 3.1% since midnight UTC, totaling a 24-hour gain of 10.9%, while Aster (ASTER $0.6114) climbed 5.7% to trade near $0.69.

Market indexes reflected the altcoin strength. The bitcoin-heavy CoinDesk 20 Index rose 2.47% in 24 hours and 2.38% year-to-date, while the altcoin-focused CoinDesk 80 Index outperformed, gaining 3.7% over the past day and 7.3% since Jan. 1.

Analysts note that bitcoin’s tight trading range often favors higher-beta altcoins, as capital rotates into more speculative tokens while waiting for a decisive bitcoin move.