China’s handling of U.S. tariffs is helping steady exports while quietly shaping the global liquidity backdrop for bitcoin.

Beijing has responded to President Donald Trump’s renewed trade pressure with restraint rather than confrontation. Instead of aggressive countermeasures, Chinese policymakers have leaned on strict currency management to offset the impact of U.S. tariffs—a strategy that is now influencing global financial conditions and, indirectly, crypto markets.

Since returning to office early last year, Trump has imposed sweeping tariffs on most imports entering the United States, including goods from China, the world’s second-largest economy and a core player in global manufacturing. By January 2026, average U.S. tariffs on Chinese imports had climbed to roughly 29.3%.

China’s response has focused on limiting volatility in the yuan. By keeping the currency tightly managed, authorities have protected exporters from tariff shock while avoiding the optics of deliberate devaluation.

JPMorgan says this approach has helped preserve China’s export competitiveness and limit deflationary pressure at home. However, it has also reinforced dollar-centric liquidity cycles during periods of heightened trade stress.

When trade tensions escalate, managed exchange-rate regimes can amplify the effects of a stronger dollar, tightening global liquidity and pushing markets toward risk-off positioning.

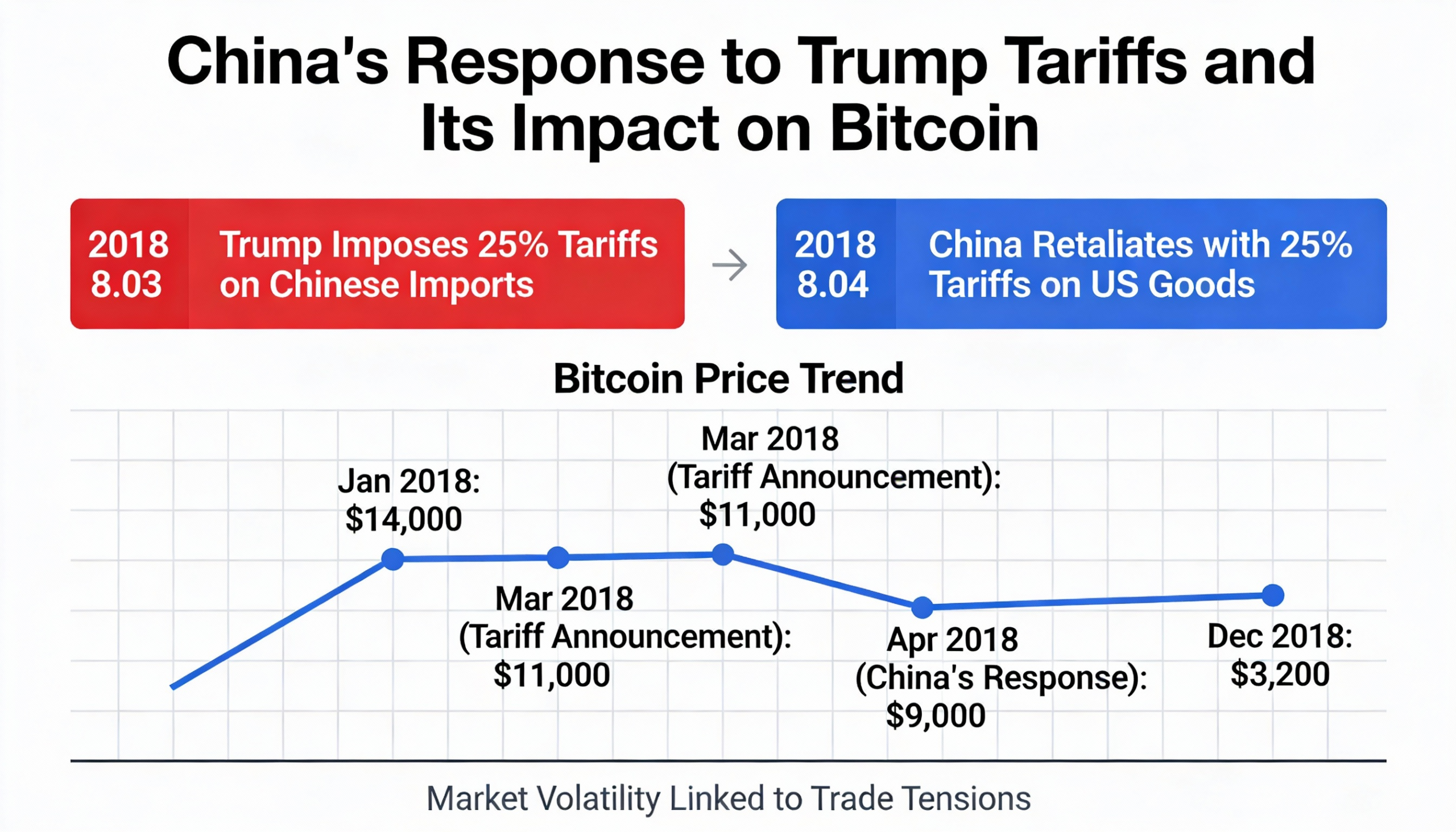

Bitcoin, which has increasingly traded in line with macro liquidity conditions, tends to struggle in that environment. The asset typically weakens when tariff-driven uncertainty drains dollar liquidity and recovers as those pressures ease. That pattern was evident in March and April last year, when rising trade tensions coincided with a sharp pullback in crypto markets, followed by a rebound as conditions stabilized.

China’s influence on crypto pricing operates indirectly, through currency management and global liquidity transmission, rather than direct capital flows. This contrasts with the United States, where bitcoin demand is increasingly shaped by institutional inflows through exchange-traded funds and other regulated vehicles.

The interpretation aligns with arguments from Arthur Hayes, who has described U.S.–China trade disputes as largely political theater. In his view, tariffs and negotiations frame the narrative, while foreign-exchange policy, capital-account tools, and dollar liquidity management determine actual market outcomes.

JPMorgan’s outlook supports that framework. While Beijing is unlikely to permit meaningful yuan appreciation, the interaction between tariffs, managed FX policy, and dollar liquidity continues to shape the macro environment in which bitcoin trades.

Exports remain resilient

According to JPMorgan Private Bank’s latest Asia outlook, China’s export sector continues to hold up despite elevated U.S. tariffs. Real exports are projected to grow around 8% in 2025, lifting China’s share of global trade to roughly 15%. Exports to the United States now account for less than 10% of total shipments.

That resilience reflects diversification toward ASEAN and other regions, as well as a policy decision to keep the yuan tightly controlled rather than allow sustained appreciation.

Although the yuan has strengthened about 4% from its 2023 lows, it remains only marginally higher against the dollar on a year-to-date basis in 2025, underscoring how narrowly the currency is being managed.

JPMorgan notes that recent yuan strength is likely seasonal. Over the medium term, policymakers are expected to maintain a stable trading range as they prioritize export competitiveness while contending with persistent deflationary pressures.

The bank added that the threshold for meaningful yuan appreciation remains high, with exchange-rate movements still largely dictated by the direction of the dollar.

For crypto markets, the implication is clear: China’s role is less about a stronger yuan and more about how managed FX policy interacts with global liquidity—conditions that continue to influence bitcoin’s macro cycle.