As gold prices climb, Aurelion is betting on tokenized bullion to reduce risks embedded in the paper gold system.

Gold has surged more than 80% over the past year, placing it among the strongest-performing assets worldwide. But while investors pile in, Björn Schmidtke, CEO of gold-treasury firm Aurelion (AURE), argues that most are overlooking a structural weakness in how gold exposure is typically held.

That weakness, he says, lies in the dominance of so-called “paper gold.”

For many investors, owning gold means buying exchange-traded funds or other financial products that track gold prices. These instruments are liquid and convenient, but they don’t provide direct ownership of physical bullion.

“When people buy paper gold, they assume they own gold,” Schmidtke said in an interview with CoinDesk. “What they actually own is a promise—a claim that only works as long as the system isn’t stressed.”

A fragile foundation

Paper gold has flourished because it removes the costs and complications of storing, insuring, and transporting bullion. But Schmidtke argues that this efficiency masks a significant risk.

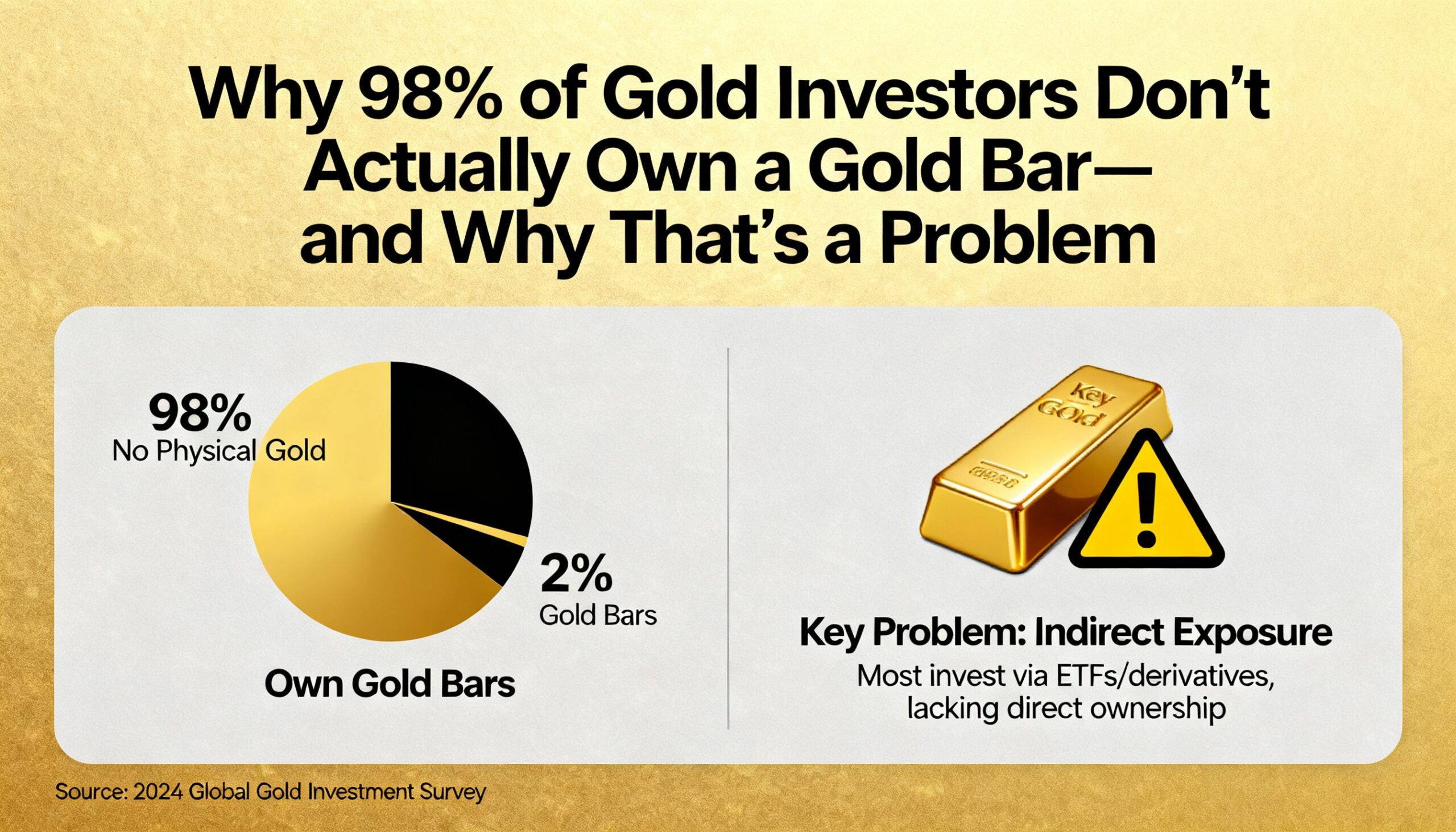

He estimates that about 98% of global gold exposure is unallocated, meaning investors hold claims that are not linked to specific bars. The system has functioned smoothly for decades largely because few investors ever demand physical delivery.

That balance could change quickly in a crisis.

If fiat currencies were to suffer rapid devaluation, investors could rush to redeem physical gold they believe they already own. In such a scenario, unclear ownership records and limited delivery capacity could create severe bottlenecks.

“You can’t suddenly deliver billions of dollars’ worth of physical gold,” Schmidtke said. “And if ownership isn’t clearly defined, settlement becomes even harder.”

In a stress event, physical gold could trade at a premium to paper instruments, leaving holders of derivatives exposed. Schmidtke points to past episodes in the silver market, where shortages drove up physical prices even as paper markets lagged.

“We’ve seen this disconnect before,” he said. “There’s no guarantee gold avoids it.”

Tokenized gold and ownership clarity

Schmidtke believes tokenized gold offers a way to address these risks by hardwiring ownership into the asset itself.

He compares paper gold to a real estate development where investors buy shares promising future apartments but never receive title deeds. When delivery time arrives, determining who owns which unit becomes slow and contentious.

Tokenized gold aims to solve that problem. With Tether Gold (XAUT), each token is tied to a specific, allocated gold bar held in Swiss vaults. Ownership is recorded onchain, allowing the “title” to move instantly without requiring the physical metal to change location.

“The gold doesn’t move,” Schmidtke said. “Ownership does.”

While physical redemption would still take time, he argues that the most critical uncertainty—proof of ownership during periods of stress—is removed. Investors can verify their holdings and trust that claims are traceable and enforceable.

Aurelion’s strategic pivot

This view has reshaped Aurelion’s treasury strategy.

The firm has shifted its gold holdings into XAUT, favoring tokenized, fully allocated bullion over traditional paper exposure. Schmidtke says the approach combines the speed and portability of digital assets with the security of physical backing.

“How you own gold matters as much as owning it at all,” he said.

Schmidtke believes tokenized gold is still in the early stages of adoption, particularly as investors become more focused on counterparty and settlement risk. Aurelion does not plan to sell its holdings unless prices trade at a “significant and sustained discount” to the value of the underlying gold.

“This isn’t a short-term trade,” Schmidtke said. “It’s about building durable exposure over time.”

The company plans to raise additional capital over the coming year to expand its gold treasury. According to CoinGecko data, Aurelion currently holds 33,318 XAUT tokens, worth roughly $153 million.