Pantera Capital says 2025 was, at its core, a full-scale bear market for most crypto tokens, despite what appeared to be a volatile but manageable year.

In its Navigating Crypto in 2026 report, the venture capital firm noted that non-bitcoin tokens have been in a sustained decline since December 2024, pressured by weak value capture, slowing on-chain activity, and dwindling retail flows. Excluding bitcoin (BTC $88,654), ethereum (ETH $2,942), and stablecoins, total market capitalization dropped roughly 44% from late-2024 highs through year-end.

The pullback drove sentiment and leverage to levels historically associated with capitulation, when holders liquidate positions in a panic. Bitcoin ended 2025 down about 6%, while ETH fell 11%, SOL dropped 34%, and the broader token market tumbled nearly 60%, with the median token down roughly 79%. Pantera described the year as narrowly focused, with only a small fraction of tokens delivering positive returns.

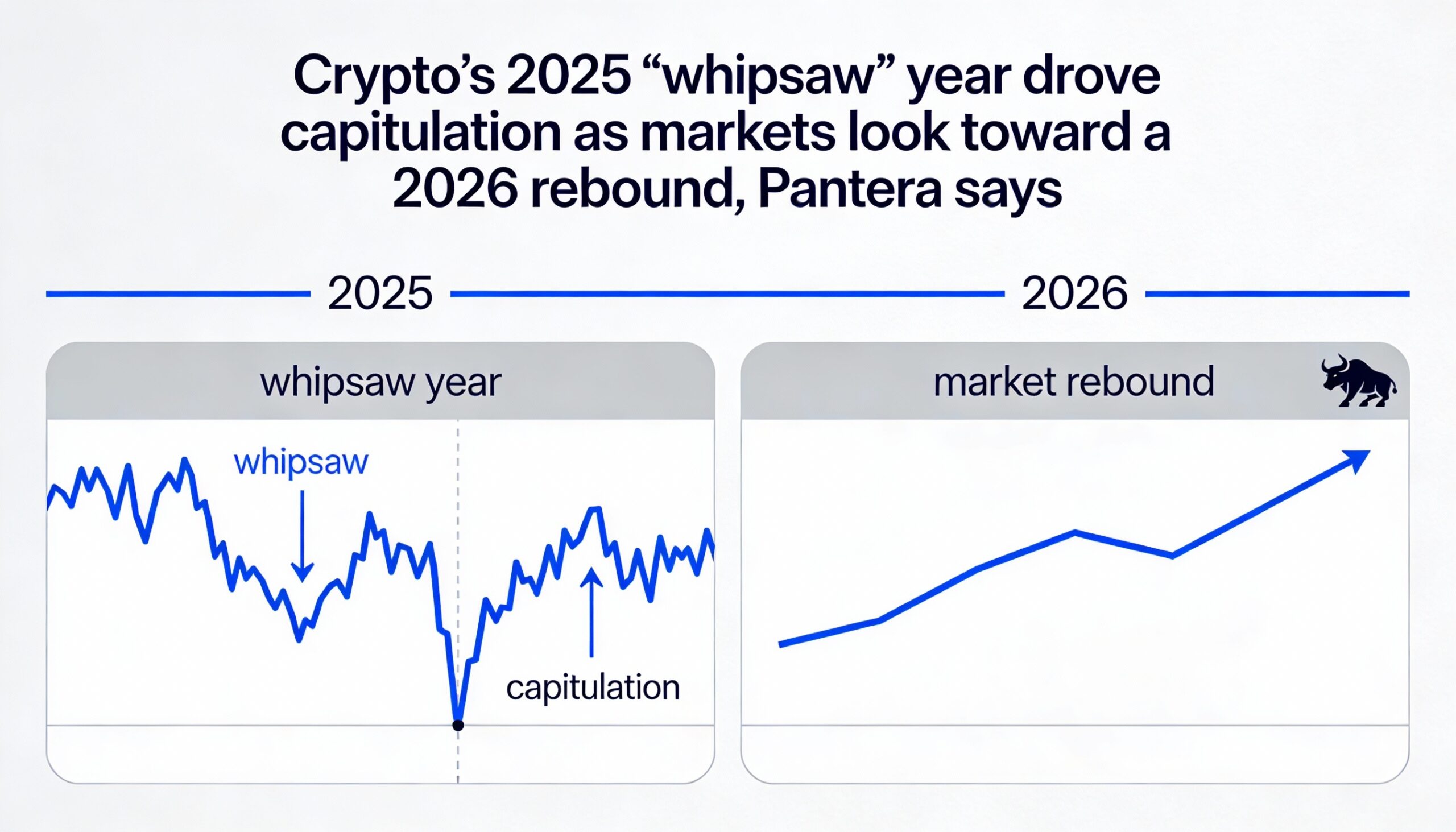

Price movements were dominated more by macro shocks, market flows, and positioning than fundamentals. The year featured repeated whipsaws linked to policy changes, tariff threats, and shifting risk appetite, culminating in an October liquidation cascade that erased over $20 billion in notional positions—exceeding losses from Terra/Luna and FTX.

Structural challenges amplified the pressure. Many governance tokens lack clear legal claims to cash flows or residual value, allowing digital asset equities to outperform. On-chain fundamentals softened as well, with declines in transaction fees, application revenue, and active addresses, even as stablecoin supply continued to expand.

Pantera said the drawdown now mirrors prior crypto bear markets, potentially setting the stage for a more favorable 2026 if fundamentals stabilize and market breadth improves. Rather than predicting prices, the firm sees next year as a capital-allocation shift, favoring bitcoin, stablecoin infrastructure, and equity-linked crypto exposure.

Partner Paul Veradittakit said 2026 will likely be driven by institutional adoption, including real-world asset tokenization, AI-powered on-chain security, bank-backed stablecoins, consolidation in prediction markets, and a wave of crypto IPOs, rather than a broad speculative token rally.