Ether Falls Below $3,000 as Bitcoin and Risk Assets Slide

Ether (ETH $2,953) led losses among major cryptocurrencies, dropping over 7% in 24 hours and slipping below $3,000 for the first time since January 2.

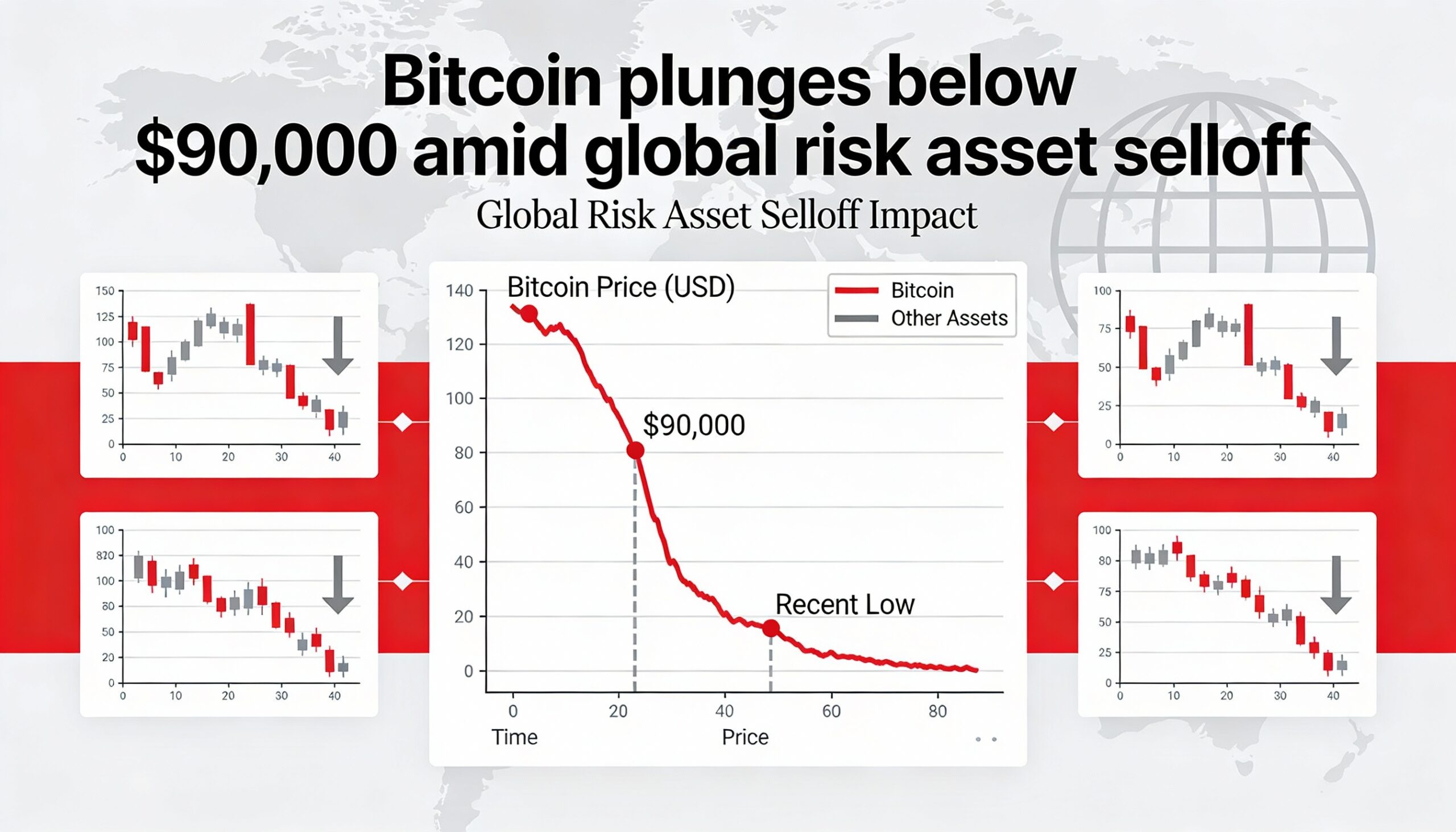

Bitcoin (BTC $89,306) fell 3% below $90,000 during U.S. morning trading on Tuesday. The selloff was driven by turmoil in Japan’s government bond market and renewed U.S. tariff threats against Europe, sending global risk assets lower.

Altcoins broadly underperformed, while Bitcoin’s market dominance—the share of total crypto capitalization held by BTC—rose to 59.8%, according to TradingView.

“Volatility is back. Bitcoin is likely to move lower with risk assets, and altcoins will bear the brunt in the short term,” said Paul Howard of trading firm Wincent.

Global equities also fell: the Nasdaq dropped nearly 2%, the Nikkei 2.5%, and Germany’s DAX 1%. Meanwhile, gold surged 3% and silver jumped 7%, both reaching record highs.

Following Tuesday’s pullback, Bitcoin has surrendered much of its 2026 gains, trading just 3% above its January 1 level.