Global borrowing costs are climbing, creating pressure for businesses and financial markets.

The 10-year U.S. Treasury yield, the benchmark “risk-free” rate, rose to 4.27%, its highest level since September 3, according to TradingView. As a baseline for global financing, the yield influences mortgages, corporate loans, and other borrowing. Large foreign holders, including China and Japan, mean rising U.S. yields push up rates worldwide.

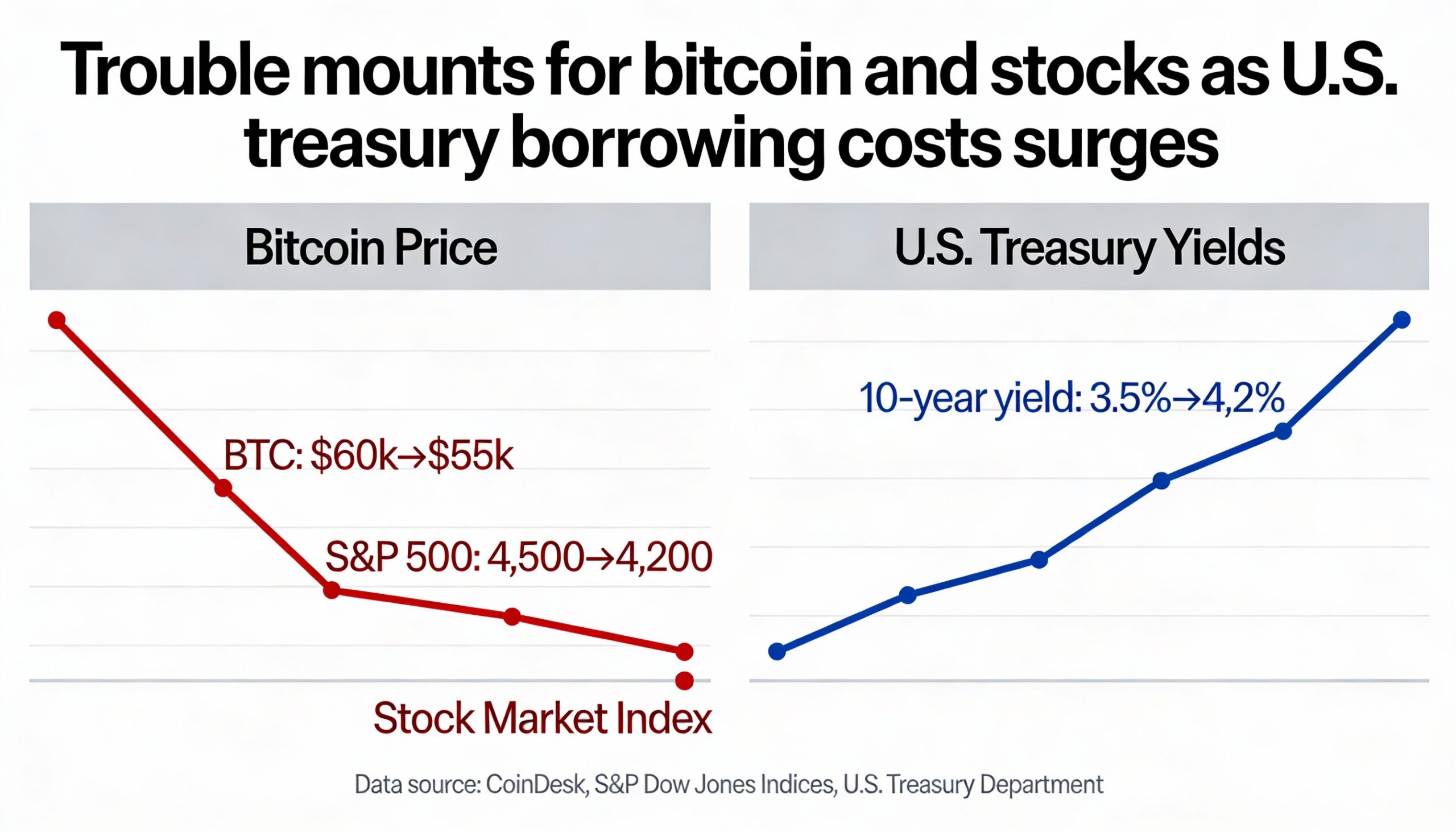

Higher yields tighten financial conditions, potentially slowing investment, spending, and appetite for risk. High-beta assets, including bitcoin, other cryptocurrencies, and equities, are particularly sensitive. Bitcoin fell over 1.5% to $91,000 in early Asian trading, while Nasdaq futures dropped more than 1.6%.

The move comes amid renewed geopolitical tensions. President Donald Trump threatened a 10% tariff on imports from eight European nations starting Feb. 1, rising to 25% on June 1, tied to his Greenland plan. European leaders criticized the threat, and speculation arose about possible retaliatory U.S. asset sales, though most holdings are privately owned.

Yields are rising abroad as well. Japanese government bonds jumped after Prime Minister Sanae Takaichi proposed food tax cuts, while higher fiscal spending and increased bond issuance are pushing rates higher across advanced economies, signaling a broader tightening in financial markets.