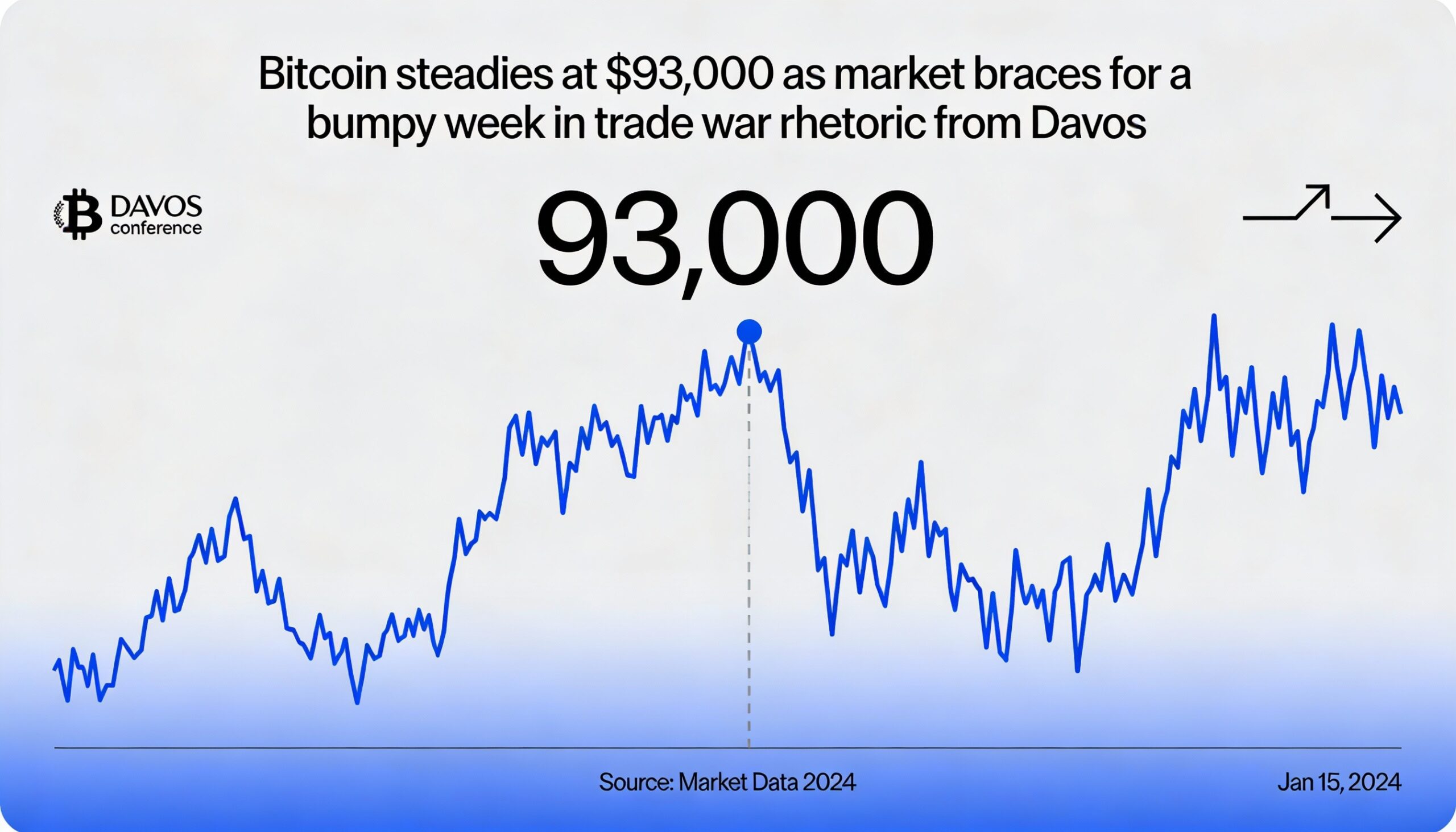

Bitcoin steadied above $93,000 during Monday’s U.S. session after an overnight dip to roughly $91,800, as renewed trade-war threats from Washington weighed on risk assets. The decline followed comments from U.S. President Donald Trump signaling possible new tariffs on Denmark and other European countries amid a dispute tied to Greenland.

With U.S. markets closed for a holiday, trading liquidity was thin, helping bitcoin retrace part of its losses, though it remained down about 2% on the day. Ether fell 3.7% to hover just above $3,200, while selling pressure intensified across the broader crypto market. Solana, Dogecoin, Cardano, Chainlink and Avalanche declined between 5% and 6%, and Sui slid more than 10%.

Gold, meanwhile, extended its rally to a fresh record near $4,700 per ounce, underscoring its appeal as a safe haven amid mounting geopolitical uncertainty. The metal is now up more than 70% over the past year.

Matt Howells-Barby, vice president at Kraken, said the pullback highlighted crypto’s ongoing vulnerability to negative macro shocks. Since the Oct. 10 crash, the market has shown “asymmetric downside risk,” with investors more inclined to punish bad news than reward positive developments, he said.

Bitcoin had been trading near levels that could have supported further upside, Howells-Barby noted, but geopolitical headlines quickly derailed that momentum. Still, the relatively contained decline of roughly 3.5% suggests traders may be positioning for a moderation in tariff rhetoric — a dynamic often referred to as the “TACO” trade.

As global political and business leaders convene at the World Economic Forum in Davos, Howells-Barby warned that crypto markets are likely to remain volatile, responding swiftly to any signals of escalation or de-escalation in EU-U.S. trade tensions.

Renewed conviction

Analysts at Bitfinex said selling pressure from long-term bitcoin holders has continued to ease, with weekly distribution dropping to around 12,800 BTC from cycle highs above 100,000 BTC.

However, they cautioned that bitcoin faces significant resistance between $93,000 and $110,000, where dense long-term holder supply has previously capped rallies.

“For a more sustainable rally to take hold, market structure must shift toward a regime where maturing supply outweighs long-term holder spending,” the analysts said.

They added that similar conditions emerged between August 2022 and September 2023, and again from March 2024 through July 2025 — periods that ultimately preceded stronger and more durable bitcoin advances.

“A transition of this kind would signal renewed conviction among long-term holders and reduce sell-side pressure,” the analysts said.