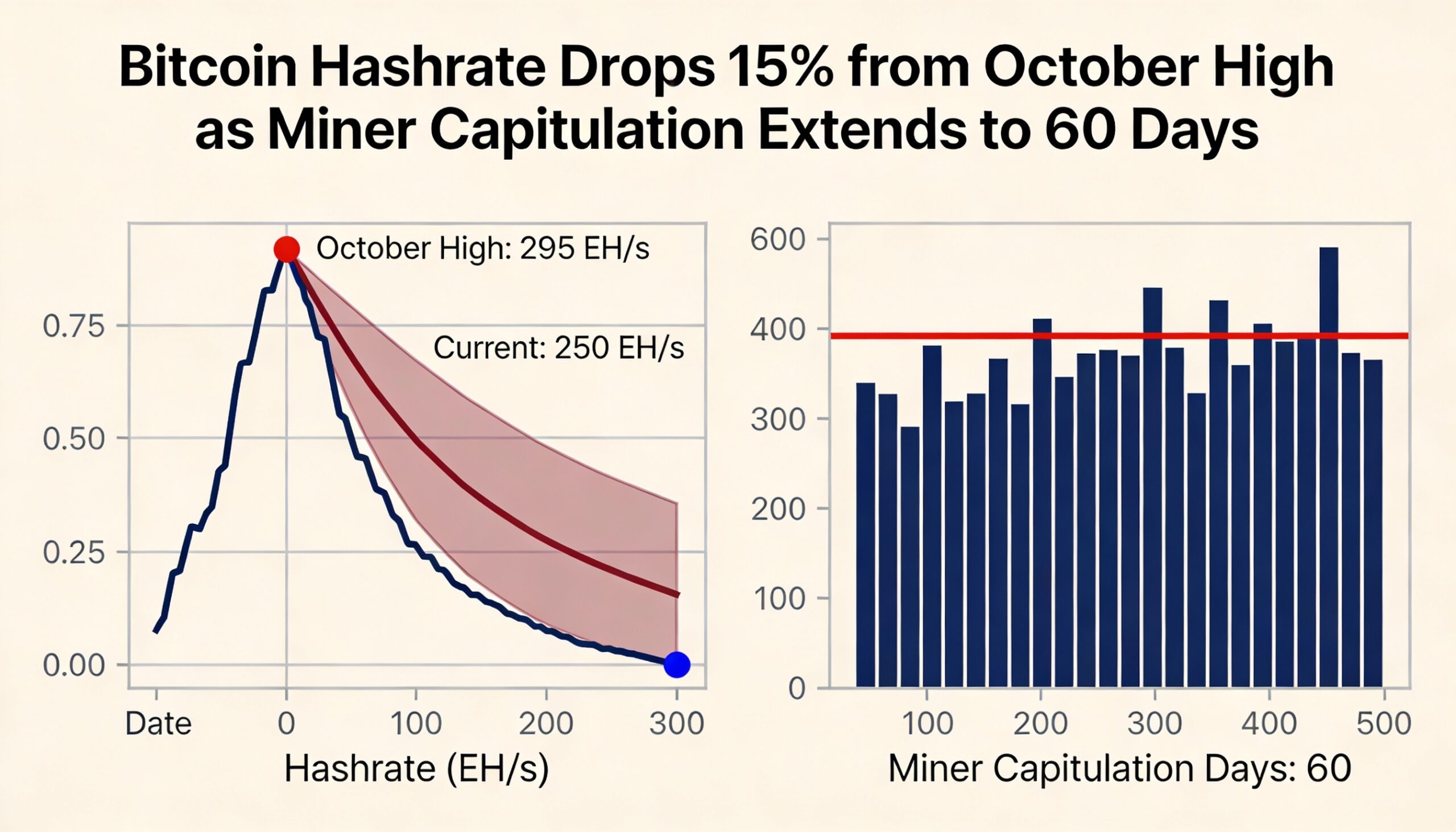

Bitcoin’s network hashrate—the computing power securing the blockchain—has dropped roughly 15% from its October peak, signaling growing stress among miners.

Hashrate has fallen from about 1.1 zettahashes per second (ZH/s) in October to roughly 977 exahashes per second (EH/s), suggesting that some miners are shutting down equipment or capitulating as profitability declines.

Glassnode’s Hash Ribbon metric, which tracks miner capitulation by comparing short- and long-term hashrate trends, inverted on Nov. 29, shortly after bitcoin bottomed near $80,000. During these periods, miners often sell bitcoin to cover operational costs, adding short-term supply pressure to the market.

Capitulation, however, is often seen as a contrarian signal. VanEck notes that periods of sustained miner stress have historically preceded renewed bitcoin price momentum as inefficient miners exit and selling pressure eases. The Hash Ribbon indicates the worst may be nearing an end once the 30-day hashrate moving average rises above the 60-day average, a setup often followed by price improvements.

Repeated negative difficulty adjustments are reinforcing the pressure. Bitcoin’s mining difficulty, which automatically adjusts to maintain 10-minute block times, is scheduled to fall 4% on Jan. 22 to roughly 139 trillion (T), marking the seventh negative adjustment in eight periods.

Additional selling is coming from miners pivoting to AI and high-performance computing. Companies such as Riot Platforms (RIOT) are liquidating bitcoin to fund capital-intensive AI and HPC projects, contributing to short-term downward pressure.