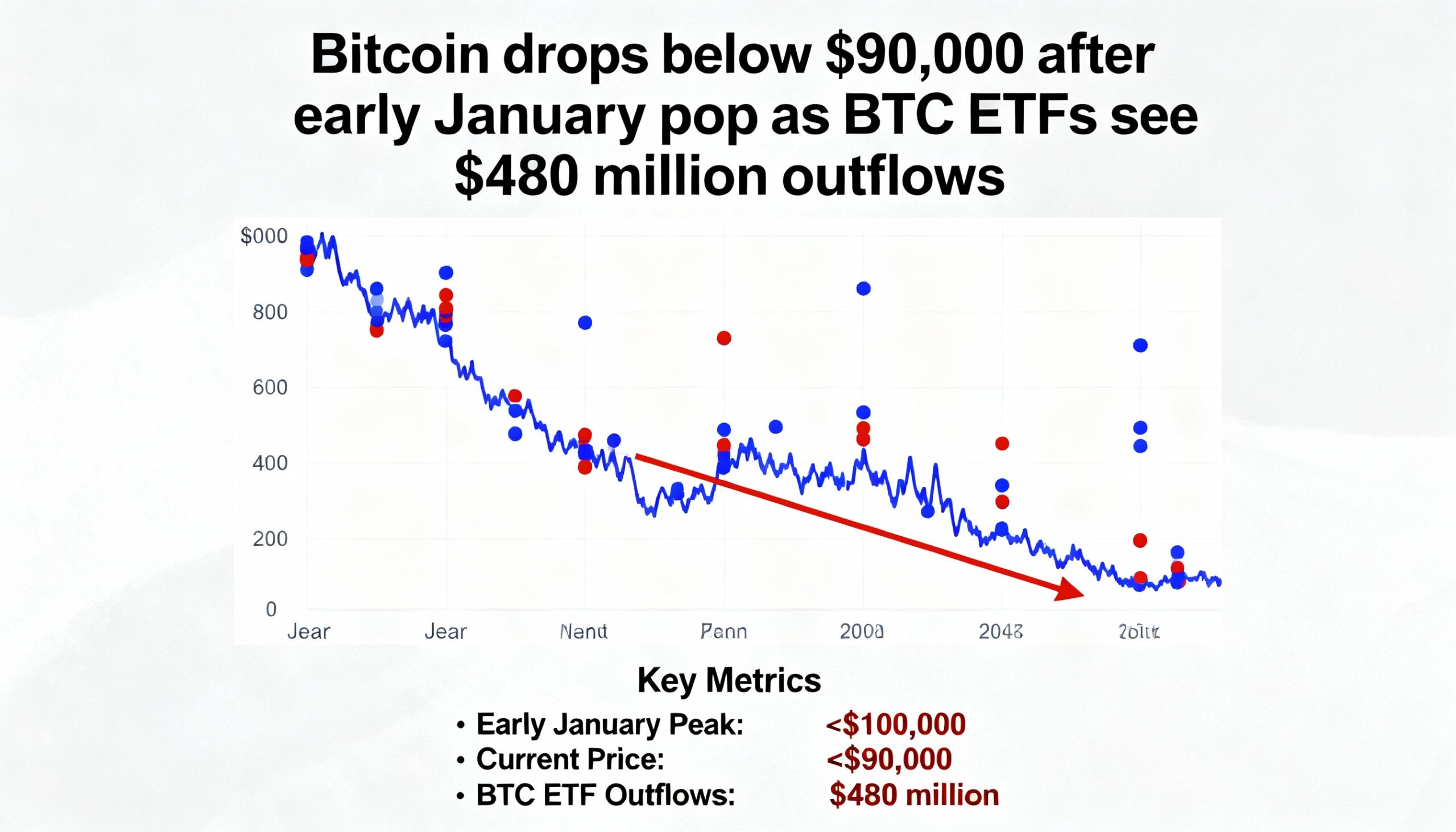

Bitcoin fell below $90,000 on Thursday as the early-January rebound cooled, even amid a global bond rally and growing bets on Federal Reserve rate cuts.

The cryptocurrency dropped roughly 2% over 24 hours but remains up more than 3% for the week. Ether slipped about 3%, holding a seven-day gain of around 6%, according to CoinGecko. U.S. spot bitcoin ETFs saw $486 million in outflows, marking their second straight day of losses this year.

Among altcoins, XRP led declines with a 4.5% drop over 24 hours, though it is still up 17% for the week. Dogecoin posted the strongest weekly gain, rising more than 22%.

Traditional markets reflected similar trends. U.S. Treasuries extended gains, pushing the 10-year yield to about 4.14% after weak December payrolls suggested the Fed may have room to cut rates later this year. ADP reported a 41,000 rise in private-sector jobs, below the Bloomberg survey estimate of 50,000. Asian bond markets followed suit, with Australian and New Zealand debt climbing and Japanese bond futures holding gains.

Analysts note that expectations of looser monetary policy typically support risk assets like crypto, especially when cash yields are low. The early-year rally also reflects post-holiday liquidity resets, but Thursday’s pullback underscores that crypto remains sensitive to bitcoin dominance and shifts in investor flows.