Strategy Outperforms as MSCI Keeps Stock in Index, While Crypto Weakness Persists

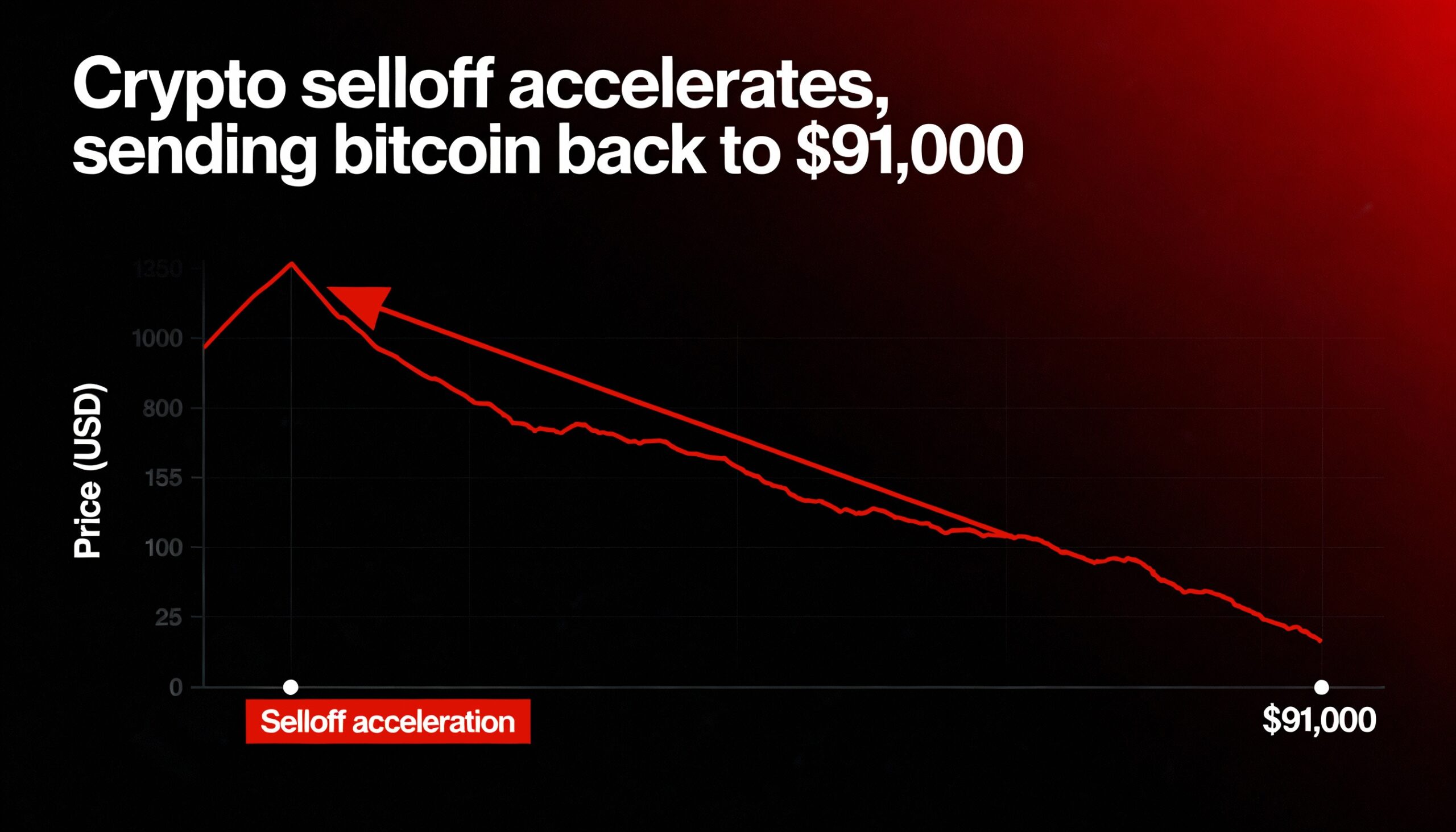

Bitcoin (BTC $91,049) and most major cryptocurrencies slipped in U.S. trading Wednesday, extending overnight losses. Bitcoin dropped roughly 3% over 24 hours, hovering near $91,100.

The CoinDesk 20 Index, tracking the top 20 digital assets, fell nearly 4%, led by XRP, down more than 8%. Ether (ETH $3,120) lost 3.6%, despite Morgan Stanley’s announcement of a spot ETH ETF.

Meanwhile, the Nasdaq rose 0.5%, while gold fell 1% and silver dropped 5%.

Digital asset treasury (DAT) stocks saw muted gains after MSCI confirmed that Strategy (MSTR) will remain in its indexes. Strategy rose 1%, outperforming peers, while Bitmine Immersion (BMNR) fell 6%, Sharplink Gaming (SBET) down 2%, and XXI (XXI) lost 5%.

On the weekly chart, the MSTR to iShares Bitcoin Trust (IBIT) ratio rebounded off the 3-level for a second week, now around 3.11. In March 2024, the ratio held at 3 before rallying to 9.5 in November, coinciding with MSTR’s all-time high. Traders will watch whether the 3-level remains a key support.